Submit or Die: ERISA Appeals Must Be Submitted within 180 Days

The Unforgiving Nature of ERISA Appeals

The Clock Starts… Now!

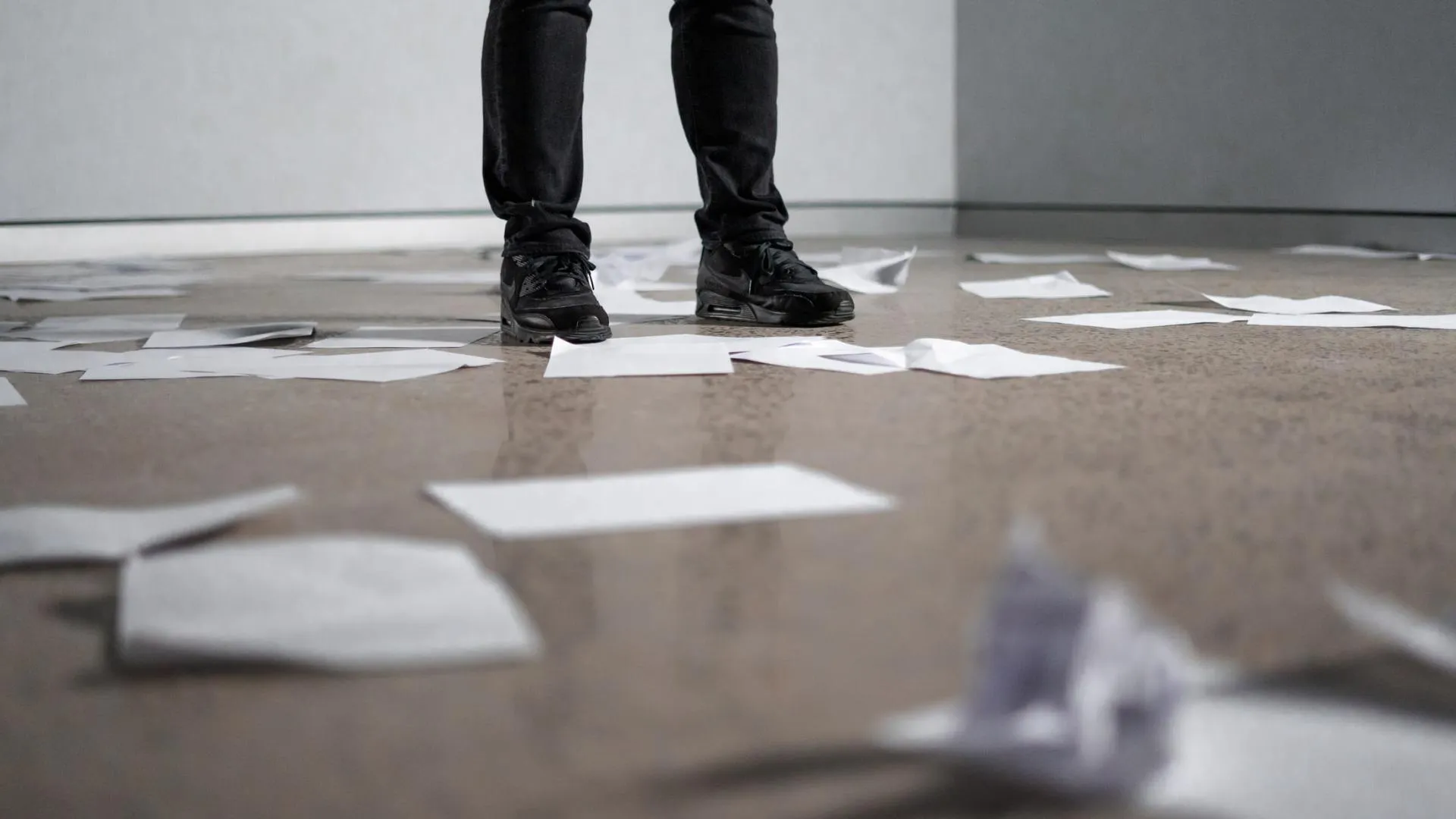

The ERISA claims process is about as forgiving as a cement floor. A person who is denied benefits after an initial application will receive a notice of denial explaining that they have 180 days to appeal the decision to the administrator who made the initial decision. ERISA appeals that are not made within 180 days of a denial are, for all intents and purposes, dead. The requirement that all claims must file ERISA appeals within 180 days is in the federal regulations relating to ERISA. (If you do not care where specifically this appears in the regulations, by all means skip the next, admittedly head-scratcher of a paragraph. For those of you who hate reading a conclusory statement without being able to gather the source of the information, by all means read the head-scratcher).

The “Head-Scratcher”

Specifically, the regulations at 29 CFR 2560.503-1(h)(4) establish that the claims procedure of a plan providing disability benefits will not be deemed to provide a claimant with a reasonable opportunity for a full and fair review of a claim and adverse benefit determination unless the claims procedures comply with the requirement of 29 CFR 2560.503-1(h)(3)(i). That regulation in turn requires a plan to provide claimants at least 180 days following receipt of a notification of an adverse benefit determination within which to appeal the determination. Because of these regulations, virtually all ERISA-governed disability plans contain a provision that an appeal must be filed within 180 days of receipt of an adverse benefit determination.

What Happens if You Didn’t File an ERISA Claim in Time?

The federal circuit courts have uniformly decided that they do not have jurisdiction over ERISA actions in which the claimant has failed to file a timely appeal. The courts have reasoned that a claimant must first exhaust their administrative remedies before repairing to the federal courts in search of a remedy. Since submitting a timely appeal is the remedy for a claim that has been denied, it is axiomatic (self-evident) that a claimant who has failed to appeal their claim has not exhausted their administrative remedies. The courts will therefore dismiss any action where no timely appeal was filed on the grounds that the claimant is not properly before the court, having failed to exhaust their administrative remedies. See Dinkwater v. Metropolitan Life Ins. Co., 846 F2d 821, 825-826 (1st Cir. 1988); Constantino v. TRW, INC, 13 F.3d 969 (6th Cir. 1994); Kross v. Western Electric Company, Inc., 701 F.2d 1238 (7th Cir. 1983); Miller v. Metropolitan Life Insurance Company, 925 F.2d 19 (6th Cir. 1991); McMahon v. Digital Equipment Corporation, 162 F.3d 28 (1st Cir. 1998). The plan administrator, for its part, could accept an untimely appeal but is under no obligation to do so.

A claimant who has missed their 180-day appeal deadline, but is hoping either that a court will hear their case or that the administrator will accept an untimely appeal, is taking a great leap of faith, and they can be fairly certain that what they land on will indeed be a cement floor.

Ordorf v. Paul Revere Life Insurance Company, 404…

Ordorf v. Paul Revere Life Insurance Company, 404 F.3d 510…

FMC Corporation v. Holliday, 498 U.S. 52 (1990)

FMC Corporation v. Holliday, 498 U.S. 52 (1990) The issue…

Why ERISA Insurers Are Working Against You

Why ERISA Insurers Are Working Against You The Insurance Industry…